Why Home Prices Are Rising Despite Predictions of a Crash

The housing market has been buzzing with chatter of a potential crash, yet home prices are soaring to new heights. What's driving this trend? Let's explore.

The Basics of Supply and Demand

Understanding the rise in home prices starts with the basics of supply and demand. Over the past decade, new household formations have outpaced the construction of single-family homes. This mismatch has created a significant shortage in housing supply.

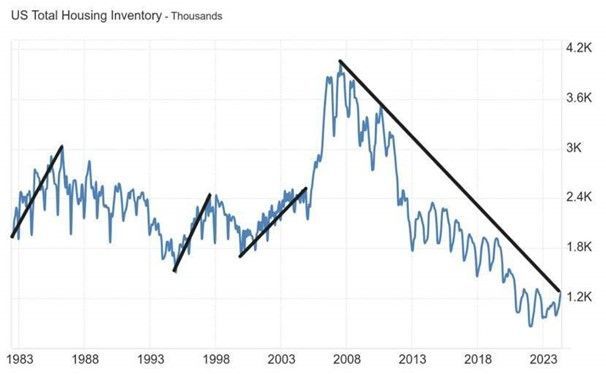

From 2012 to 2022, the number of households grew rapidly, but the construction of new homes lagged behind. The historical average number of homes listed for sale in the U.S. typically ranges between 2 to 2.4 million. Today, we have around 1.2 million homes available — half of the usual supply.

High interest rates and demographic factors, like millennials entering the market for family homes, have intensified this imbalance. With fewer homes available and strong demand, prices naturally rise.

Debunking the Myths

Contrary to predictions of a housing market crash, the ongoing increase in home prices is primarily due to the severe imbalance between supply and demand. Economic downturns, such as the Great Recession, had long-lasting effects on home construction, making recovery slow.

The slow return to pre-crisis building levels has left a lasting shortage, driving competition among buyers and pushing prices higher. This dynamic remains prevalent despite some forecasts suggesting otherwise.

Historical Context

Examining historical trends, we find that the current number of homes for sale is significantly lower than the average over the past 40 years. This reduced supply, combined with steady demand, keeps pushing prices up.

These supply constraints are not just a recent phenomenon but part of a longer historical trend influenced by economic cycles and policy decisions.

The Future of Home Prices

Given the persistent supply constraints, it's likely that home prices will continue to rise in the foreseeable future. High mortgage rates discourage existing homeowners from selling, further limiting the housing inventory.

While changes in economic conditions and increased construction could stabilize prices eventually, the current trend points towards continued price growth. Staying informed and focusing on fundamental economic principles can provide a clearer picture of where the market is headed.

Conclusion

In summary, the rise in home prices is a straightforward result of supply and demand dynamics. Despite predictions of a crash, the reality is that until the supply of homes increases significantly, prices are likely to remain high.

For those navigating the market—whether buying or selling—understanding these foundational economic principles is crucial. Staying educated and aware of the factors driving market changes is the key to success. Contact my team today if you want to learn more about what we're seeing in this current market.