What Homebuyers Need to Know About the Recent Federal Interest Rate Cut

In a surprising move, the Federal Reserve has cut its benchmark short-term federal funds rate by 0.5%. This is the first reduction we've seen in four years. While this may lead you to believe that all borrowing costs, including mortgage rates, will drop, the reality is a bit more nuanced. Even though rates were cut, that doesn't mean mortgage rates went down as a result. The federal funds rate influences how much banks pay to borrow money overnight from one another, which is quite different from the long-term rates that determine mortgage costs.

We'll break down what this rate cut means for you as a homebuyer, homeowner, realtor, or real estate agent. Understanding the intricacies of these economic changes can help you make better financial decisions, whether you're buying a home, refinancing, or simply staying informed.

What Does the Fed Rate Cut Mean?

First, it’s crucial to understand what the federal funds rate is. This rate is the interest rate at which banks lend money to each other overnight. It’s not directly tied to mortgage rates but does influence other types of loans like credit cards and auto loans. When the Fed lowers this rate, borrowing generally becomes cheaper in these areas, encouraging spending and investment.

How Does it Impact Consumer Loans?

For general consumers, the immediate effects of a Fed rate cut are most noticeable in credit card interest rates and auto loans. These rates might drop, making borrowing more affordable. If you have credit card debt or are planning to finance a new car, you may start to see lower interest rates. However, these changes aren’t always immediate and can vary depending on the lender.

Mortgage Rates and the Fed Rate

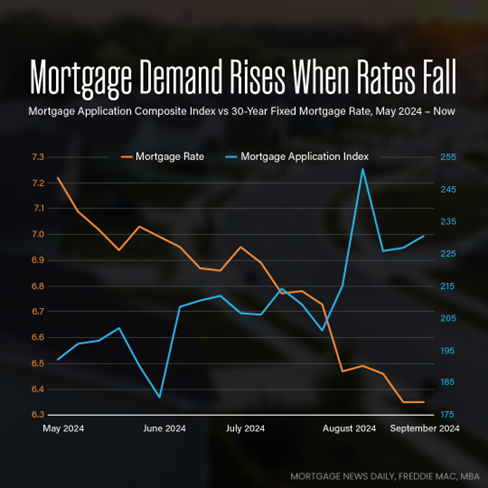

It’s a common misconception to think the Fed's rate decisions directly affect mortgage rates. In reality, mortgage rates are more closely tied to the bond market and other economic factors like inflation and employment. While the overall economic environment influenced by the Fed can impact mortgage rates, they don’t move in lockstep with the federal funds rate.

This means that even though the Fed has lowered rates, you might not see an immediate decrease in mortgage rates. Sometimes, they can even increase if investors believe the economy will strengthen. However, over time, the general trend might lean towards more favorable mortgage rates, which we monitor closely to advise our clients accurately.

What Does This Mean for Home Buyers and the Mortgage Industry?

For potential homebuyers, the current environment suggests a few key points:

- Strategic Buying: Now might be a strategic time to consider buying a home before the broader market jumps back into home purchasing in the spring. With the potential for future rate decreases, getting in before a significant influx of buyers could be beneficial.

- Refinancing Opportunities: If mortgage rates do fall in the future, there may be opportunities to refinance and secure a lower rate, saving money over the life of your loan.

- Expanded Buyer Pool: Lower interest rates across the board can increase the number of people who can afford to borrow, potentially increasing the demand for homes and creating a more competitive market.

Luminate Home Loans' Commitment

At Luminate Home Loans, we don't just follow trends—we anticipate them. We understand the importance of accurate, up-to-date information and are committed to advising our clients based on solid economic principles and comprehensive market analysis. Our goal is to help you make informed decisions that align with both your immediate financial situation and long-term financial goals.

We’re here to navigate these changes with you, offering expert guidance every step of the way. Whether you're buying a new home, refinancing, or just seeking advice on how these rate changes could impact you, let us be your partner in navigating the mortgage landscape.

And while we can't predict the future, we have the expertise and resources to keep you well-informed and prepared for whatever comes next.